External Environment

The Global Economy

The global economy in 2012 was characterized by a double dip slow down with a continuing euro zone debt crisis, slow recovery in the US and a decline in growth in the Asian Region. Despite the dark clouds, 2013 promises a few silver linings.

Forecast1 global growth for 2013 is expected to moderate at 3.6%, but an improvement over the 2012 figure of 3.3%. Advanced economies which grew by 1.3% in 2012, and are expected to recover marginally to 1.5% in 2013, as they continue to be dampened by public spending cutbacks and still weak financial systems.

In contrast, emerging and developing economies which grew at 5.3% in 2012 and are expected to grow at 5.6% in 2013. Although down from the 6.2% growth in 2011, fundamentals remain strong in many of these economies with demand propelled by high employment growth and consumption, together with investments attracted by the easing of macroeconomic policy.

There is a divide in the Middle East and North Africa (MENA) region on economic growth depending on whether one imports or exports oil. Oil importing countries are affected by the continued uncertainty associated with political and economic transition in the aftermath of the Arab Spring and weak terms of trade; and their collective real GDP growth is forecast to have slowed down to about 1.3% in 2012 and rebound moderately in 2013. On the other hand, the overall pace of growth among oil exporters rose sharply to above 6.5% in 2012, aided by windfall gains, and then return to about 3.8% in 2013.

The volume of world trade saw a slump in 2012, down to 3.2% from 5.8% in 2011 and 12.6% in 2010.

The US introduced a low interest rate regime in response to the financial crisis in 2007 to help households and businesses finance new spending and help support asset prices. These rates of interest are expected to continue for some time given the slow recovery, higher unemployment levels and inflation remaining subdued.

For prospects to improve from a global perspective two crucial requirements must be met. Firstly, European policymakers need to get the euro zone crisis under control; and secondly, the US has to tackle the 'fiscal cliff' and not allow automatic tax increases and spending cuts to take effect.

1 IMF, World Economic Outlook, October 2012.

Saudi Arabia

The Kingdom of Saudi Arabia (KSA) is a petroleum-based economy with government controls over major economic activities. The petroleum sector accounts for about 70% of budget revenues, 55% of GDP and 90% of export earnings.

After many years of negotiations pertaining to the easing of protectionist barriers, KSA was officially approved to join the World Trade Organization in 2005. The government now encourages private sector participation in selected sectors to diversify the Saudi economy and to employ more nationals to tackle rising unemployment. Foreign investments are permitted in sectors including infrastructure development, power generation, telecommunications, natural gas exploration and petrochemicals.

Supported by high oil revenues KSA has substantially increased spending on job training and education, infrastructure development and government salaries. Six 'economic cities' in different regions of the country are being established to promote foreign investment and an estimated USD 373 billion will be spent between 2010 and 2014 on social development and infrastructure projects.

The Mini-boom will Moderate

On the economic front, the Saudi GDP growth levelled off at 6.8% in 2012 following two years of ascending growth rates. It is forecast to moderate in 2013 as the global economic slowdown continues to affect emerging and developing economies through both trade and financial channels. The expected decline for KSA is also a reflection of the easing of the Kingdom's record oil exports following the temporary shutdown of Libyan oil production and sanctions on the export of Iranian crude. Further, slow global economic growth will restrict annual oil demand, while prices should stabilize unless driven up by geopolitical tensions.

Looking Beyond Oil

While the petroleum sector continues to underpin the economy, it is the non-oil sector that will create the much needed jobs in the Kingdom. For instance the government's Nitaqat programme sets targets for companies to hire Saudi nationals, and provides incentives for those who meet them and disincentives for those who don't. The government launched the next phase in August 2012, which aims to further raise the salaries of Saudi employees.

About half of the USD 131 billion stimulus package announced by the Custodian of the Two Holy Mosques was for housing, a key issue for a population that is growing at 2% per annum. The recent Mortgage Law is expected to accelerate housing starts and also benefit sectors such as construction, raw materials, real estate, insurance and banking.

Managing Inflation

Although inflation stabilized at around 5% during 2012 the situation needs watching. Rising rent and food prices contributed significantly to inflation during the year. Similarly demand for construction materials and labour on the back of the approval of the Mortgage Law could see inflation heading upwards. If so, analysts argue2 that the Saudi Arabian Monetary Authority (SAMA) may be tempted to reverse some of the liquidity-easing measures it took in the wake of the 2008 global financial crisis, and such a reversal may undermine the recovery in private sector lending.

A Comfortable Fiscal Cushion

Estimates of the Saudi foreign reserves vary, with the IMF indicating a comfortable middle figure of USD 700 million by end 2012. Nevertheless,the IMF has emphasized the need to ensure that the Kingdom uses its oil revenue and foreign reserves prudently, such as for sustainable and inclusive economic development and job creation.

Addressing Socio-Political Issues

Like the rest of the MENA region, KSA is going through demographic changes. About a third of the Saudi population is under 15 years of age, which in turn creates pressures on education and affordable housing in particular, as well as a call for social, economic and political reforms. Given this scenario it becomes imperative that the authorities continue to work fast on both short-and long-term measures that will address these concerns.

2 EIU, Saudi Economic Outlook 2012

The Saudi Banking Sector

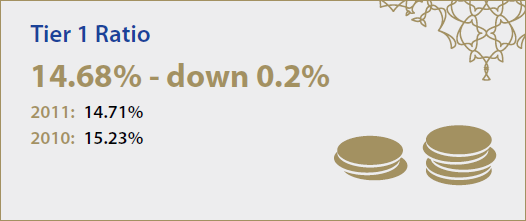

Overall, Saudi banks continue to post attractive profits despite the low interest rate scenario and high provisioning. The latter is largely due to conservative banking regulations. Nevertheless, such conservative regulatory requirements have helped the Saudi banking system to emerge relatively unscathed from the global financial crisis, and banks are continuing to maintain profitable operations.

Non-performing loans of Saudi banks continue to be relatively low and hence, overall asset quality remains intact.

A positive outlook prevails on loan growth, with double digit growths in 2012 and 2013. Retail lending remains favoured by most banks as this segment is perceived to be under penetrated. Although the new Mortgage Law is not expected to have an immediate impact for the reasons discussed below, it signals support for the medium-to long-term growth of the retail segment.

Margins have shown some contraction, particularly for the Islamic banks. Funding mix is an issue that is being felt across the sector, which may raise funding cost. With the slow down in the growth of current accounts and the need to maintain the Loans : Deposits ratio below 85%, banks may selectively look to grow their profit bearing deposits to fund asset growth which may lead to further decline in margins. However, so far this appears to have been offset as banks have focused on fee-based revenues via cross sell.

The Mortgage Law

The Mortgage Law is a bold step of the government towards addressing the economic and social challenges in the area of housing. It also poses numerous opportunities as well as challenges for the banking sector, not only in terms of direct mortgage lending, but also in serving the needs of several other sectors arising from the multiplier effect on the economy.

More remains to be done. For instance the Guidelines for legislation of real estate financing, leasing of housing, settlement of disputes and the like are still being formulated. Banks would also like to understand how foreclosure procedures would really work through the legal system to gain some confidence before any significant lending can commence.

Further, for the Mortgage Law to be effective, there must also be a parallel growth in the supply of affordable housing. This then leads to the question of availability of buildable land, a key input that continues to be scarce. A possible solution would be the imposition of a tax on undeveloped land. Going forward, while the Mortgage Law will facilitate bank lending, these underlying issues also need to be tackled simultaneously.

OPERATIONS REVIEW

Core Competencies and Strengths

As a Shariah compliant Saudi Arabian bank with a strong Saudi franchise, Al Rajhi Bank is well respected for its exemplary performance and business ethics that have been honed over a 25-year banking history coupled with a business heritage spanning over half a century. It is the world's largest Islamic bank and the largest commercial bank in the GCC region in terms of market capitalization.

Al Rajhi Bank is engaged in banking and investment activities for its own account and on behalf of others inside and outside the Kingdom. The Al Rajhi Bank Group or 'Group', as used in the discussion that follows, represents the consolidated operations of Al Rajhi Bank3 ('Bank') - the holding company - and its four subsidiaries, including that based in Malaysia and branches in Kuwait and Jordan.

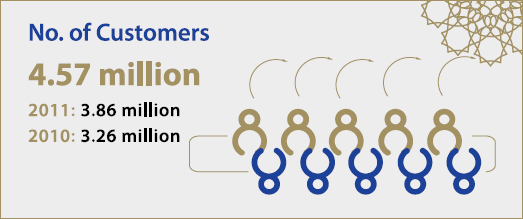

Through a total of 495 branches in Saudi Arabia, over 3,400 customer delivery points including ATMs as well as a comprehensive range of virtual channels, the Bank enjoys a widespread presence in the Kingdom. Its customer base exceeded 4.5 million during the year. Deposits mobilised are granular and are of varied tenors to manage concentration risk as well as liquidity and profit rate risks.

Our dedicated and competent team is the very backbone of our success. The Group's human capital grew by 8.3% from 9,282 to 10,054 employees during the year to support business growth. Our 110 dedicated Ladies branches employ over 800 females.

Our operations are duly supported by progressive governance standards, sound risk management systems and unparalleled back office capabilities, while the Bank continues to develop its state-of-the-art IT platform and electronic channels.

The Bank continues to lead the Saudi banking sector across key financial indicators and metrics-

- No. 1 in profitability

- No. 1 in profit rate

- No. 1 in cost to income ratio

- No. 1 in loans and advances

- No. 1 in market capitalization among banks in the GCC

The Group delivered yet another solid performance in 2012, with a strong total assets growth of 21.1% from SR 220.7 billion to SR 267.4 billion, while total comprehensive income increased by 6.9% from SR 7.38 billion to SR 7.88 billion. The Group posted a healthy 3.23% return on total assets (2011: 3.64%) and an attractive 22.54% return on shareholders' equity (2011: 23.13%), duly supported by a low cost to income ratio of 27% with about 85% of customer deposits being in current accounts.

3 Formerly know as Al Rajhi Banking and Investment Corporation

Strategic Priorities

Al Rajhi Bank is focused on sustainable growth underpinned by its seven core values. These values provide us guidance in caring for our society and environment, nurturing creativity and innovation, serving our customers with passion and commitment, being resourceful and solution oriented, fostering meritocracy in our people, striving for the highest standards of integrity and transparency while maintaining humility in thought and deed in everything we do.

In this regard, it is relevant to mention that all what we do - both business units as well as support service units - are singularly focussed on our strategic priorities that are detailed below:

Be the Most Profitable Bank in Saudi Arabia

We have always prided ourselves in being number one in terms of profitability in the market. Driving this profitability are four-key factors: our retail dominance, funding largely through a cost efficient deposit base, a low cost to income ratio and very low non-performing loans (NPL) ratio. This pre-eminent position has given us a strong reputation in terms of market visibility and has enabled us to be the highest paymasters when it comes to dividends to shareholders. Our franchise has enabled the generation of regular core revenues which contribute to consistent, sustainable performance year after year.

Enhance and Maintain the Bank's Strong Retail Position in the Kingdom

Retail financing accounts for some 65% of our financing assets and 65-70% of our net income. It is a core source of income that is consistent. The Bank maintains a sharp focus on this business segment which has grown not only in volume but also in terms of market share. The latter increased from 27% in 2007 to 40% by 2012, which is more than double that of our nearest retail competitor, no mean achievement.

This strong growth was driven by several factors, the most important being our ability to grow current accounts in tandem to fund our retail financing, and the emergence of new business opportunities.

The former - our ability to grow our current accounts - is driven partly by our sound reputation, strong branding and wide distribution channels. Another noteworthy factor is that most of the current account growth comes from affluent, knowledgeable and educated customers who, from an Islamic cultural point of view, avoid interest-bearing deposits.

As for new opportunities, one is the increasing number of Saudis entering the workforce. They are mostly employed in the government sector and enjoy a stable income, which in turn contributes to low NPLs for the Bank. This is a segment that is growing given the government's drive on job creation, including Saudization in the private sector. Another opportunity is the current trend where females are entering the workforce in large numbers as rules are being relaxed gradually. We have geared ourselves to serve this segment and presently operate 110 Ladies branches. Mortgage financing is another area that has been largely untapped, and will be another growth area in the medium term as the pressure for housing mounts.

To support these tremendous opportunities the Bank already has in place a wide network of branches, ATMs as well as virtual channels. They are well ahead of competition, and duly matched by our solid reputation, long-standing customer relationships, superior know how and processes as well as enormous back end processing capacity to keep pace with growing volumes.

Grow Corporate Banking

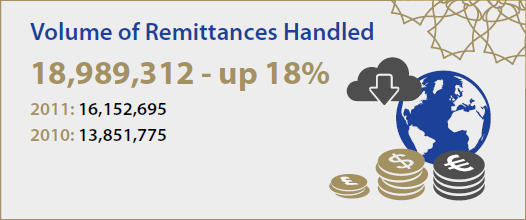

Financial institutions (FI), cash collections and trade are the three main areas of our corporate banking business. FIs come from our remittance background, and we have relationships with about 170 to 180 correspondent banks. We are leveraging on these relationships, either for correspondent banking business, remittance needs or funding short-term financial needs. Cash collections have grown about 150% YoY, and 400% YoY in terms of fees. On trade, we are reasonably strong, with most of the action coming from the non-oil side. The present focus is on product development and setting the right pricing.

SMEs will be a focus segment in the years ahead as we plan to increase the number of relationships. This will be supported through the launch of two new acquisition programmes to cater to a wider spectrum of SMEs operating in the Kingdom apart from the existing Kafalah programme for SMEs.

We are planning to roll out the payroll cards to further strengthen the transaction network. Another is the introduction of a 'lock box', a new product concept for the Middle East, for cash deposits. This involves providing lock boxes at customer locations for depositing cash which would then be reflected in their accounts in real time.

Another new product that is being considered is the introduction of social cards such as Haj/Umrah cards to enable pilgrims visiting the Kingdom to carry out hassle free transactions.

In addition, migration to a comprehensive e-banking platform is being considered. This will combine the existing features of e-Corporate and e-Trade to offer a more powerful and seamless tool for customers to manage their day-to-day transactions.

Innovate Shariah Compliant Investment Products Through R&D

As an Islamic bank, all products and services offered by the Bank and its subsidiaries are in full compliance with Shariah principles. Each business unit is assigned a Shariah co-ordinator who engages in discussions and helps the unit to prepare products in a Shariah compliant manner. It is then reviewed by Shariah scholars of the Shariah Board.

There are two key challenges faced by the Bank in this context. First, as to be expected, we are prescribed by Shariah principles that prevent us from doing business the way conventional banks do. The avoidance of usury is a simple example. Second, there are differences in the interpretation of Shariah principles among Islamic banks. We strictly follow Shariah with no room for leeway, which explains why we do not offer some of the products available in other Islamic banks, say in Malaysia, Indonesia or Turkey. For instance, our Shariah rules on corporate bonds or Sukuk are more stringent, which makes it all the more challenging in bringing such products to the market.

The Bank has innovated Shariah compliant refinancing models for both retail and corporate customers. These are recent success stories that have helped in delivering bottom line profits, mitigate risk and improve our services to customers.

As for the immediate future, Sukuk is an area that will need to be further developed to improve the yield, which will also help us to manage liquidity better as it is a marketable instrument. Another is to develop Shariah compliant hedging instruments, particularly a forward forex product.

Challenges remain, as some of the topics are very technical, documentation is too detailed and translations are time consuming. One approach would therefore be to engage with issuers early, and for the Bank to internally drive the development of some of these products.

Develop Core Competency in Funding

The Bank will need to further develop its competency in funding through current accounts, while selectively developing capabilities to attract other forms of deposits.

Al Rajhi Bank is different from the rest - a very large proportion of our retail financing is funded through current accounts, which are by and large core 'long-term deposits' and are not volatile. We discussed this unique feature earlier under the section on retail banking strategies. Thus, when rates start picking up, we are one of the few banks that will not be as affected by re-pricing because we are funded predominantly by current accounts.

However, we are mindful that the market is changing, composition is changing, current accounts are slowing down and banks are developing models and fund mobilization products. One of the key products the Bank will develop is a fixed deposit aimed at the retail customer base, as opposed to the present big ticket deposits as they also provide granularity.

Manage Our Margins to Maintain Profitability

Current account funding is our core competency and market differentiator. However, when rates are low and get lower the cost advantage gets diminished as competitors re-price their liabilities at lower rates. This in turn applies a squeeze on our net interest margins. But, the upside is that when rates pick up we are in a much stronger competitive position because the bulk of our funding liabilities do not re-price.

To manage such cycles we will turn to mechanisms such as cross sell, better penetration and off-balance sheet fee income. The last has seen a phenomenal increase in recent times. We have strategically looked at enhancing and improving our fee generating capabilities not only as an income source but also to offset lower returns on yields given the low interest rates, thus maintaining our position as the most profitable bank in the Kingdom. Our cross sell income ratio has roughly doubled over the past five years.

This is a capital efficient way of generating income. Retail banking will generate retail processing fees driven by retail financing. Corporate banking will generate fee-based income on activities such as corporate structuring, arranging deals and granting loans. Other sources will include revenues flowing from remittance business, trade, credit cards and FIs.

Control Non-Performing Assets

The Bank will continue to monitor and control its Non-Performing Loan (NPL) ratio, which has historically been the lowest in the Kingdom. This will be achieved through prudent appraisal at loan approval stage, and then through post disbursement follow up. The latter includes monitoring of NPL ratios by business segments, NPL coverage ratios based on general and specific provisions and collections from NPLs.

Maintain Operational Cost Efficiency

Managing and maintaining the cost to income ratio within acceptable limits is of utmost priority for profitability and growth. The Bank has maintained the best ratio in the Saudi market over the past several years, averaging 26-28%. To manage such performance the Bank will continue to invest in technology, adopt new productivity enhancing techniques and processes and look for economies of scale as we grow our business.

Stabilize and Grow International Business

The Bank moved into international business to diversify its revenue base and to explore opportunities in emerging markets. We wanted to be present, learn and understand the markets, and establish a brand in those markets, particularly in Malaysia. Our strategy now is to address what we have learnt, work on strengths while overcoming weaknesses, and take the business forward on a planned footing.

Leverage Technology to Achieve Operational Excellence

The Bank will continue to be the best in class on operational excellence - from processing unparalleled volumes, ATM availability, disaster recovery, security standards, applications for online customers etc. - largely driven by technology. This will encompass not only state of the art superior customer service and response times but also security initiatives, disaster recovery and the like.

Products and Services

The Group operates along four main business segments comprising retail, corporate, treasury, and investment services & brokerage. The last mentioned is delivered through the Saudi-based wholly-owned subsidiary, Al Rajhi Capital Company which also includes franchise-related positions/expenses.

The financing needs of retail and corporate customers are met through five Shariah compliant product groups.

Financing

Net financing accounted for 64.3% of the consolidated total assets of the Group as at December 31, 2012 (2011: 63.6%) and represents the main driver of revenue and balance sheet growth.

Net financing by products and location as at December 31, 2012, SR million4.

| Product | Inside KSA | Outside KSA | Provision | Total net Financing | Composition, % |

| Corporate Mutajara | 34,422 | 836 | (2,210) | 33,047 | 19.2 |

| Instalment sale | 124,595 | 2,992 | (1,826) | 125,762 | 73.1 |

| Murabaha | 9,849 | 3,500 | (785) | 12,564 | 7.3 |

| Credit cards | 577 | 3 | (12) | 568 | 0.3 |

| Istisnaa | 0 | 0 | 0 | 0 | 0 |

| Total | 169,443 | 7,331 | (4,833) | 171,941 | 100.0 |

4 Details are given in Note 6-1 to the consolidated financial statements.

In composition terms, instalment sale is by far the largest financing product overall, accounting for nearly three-fourths of net financing, followed by Corporate Mutajara. Retail personal loans sales grew by 25.7% YoY from SR 100,032 million to SR 125,762 million, and was by far the largest contributor to the growth in net financing portfolio among all products.

Total net financing increased by 22.5% from SR 149,313 million to SR 171,941 million during the year, with all products showing growth except for Istisnaa, which reduced to zero from a brought forward balance of SR 0.56 million.

While financing is predominantly Kingdom based at present, growing international footprint is gradually helping the Bank to diversify its revenue sources.

Net financing by products and key segments as at December 31, 2012, SR million5

| Product | Retail | Corporate | Total | ||

| SR million | % of retail | SR million | % of corporate | SR million | |

| Corporate Mutajara | 0 | 0 | 35,258 | 62.4 | 35,258 |

| Instalment sale | 118,437 | 98.5 | 9,151 | 16.2 | 127,587 |

| Murabaha | 1,260 | 1.0 | 12,089 | 21.4 | 13,349 |

| Credit card | 580 | 0.5 | 0 | 0 | 580 |

| Istisnaa | 0 | 0 | 0 | 0 | 0 |

| Sub total, gross | 120,277 | 100.0 | 56,497 | 100.0 | 176,774 |

| Provision | (2,598) | (2,235) | (4,833) | ||

| Total net financing | 117,679 | 54,262 | 171,941 | ||

5 ibid

Retail accounts for two-thirds of the net financing portfolio, with complete dominance by instalment sale. The corporate portfolio is dominated by Corporate Mutajara.

The net retail portfolio grew by 26.2% during the year from SR 93,225 million to SR 117,679 million while the net corporate portfolio grew by 15.2% from SR 47,089 million to SR 54,262 million with increases seen in all products.

Net financing by economic sectors as at December 31, 2012, SR million6.

| Sector | Net Financing | YoY Change, | |

| FYE 2012 | FYE 2011 | % | |

| Personal | 118,534 | 85,327 | 38.9 |

| Commercial | 20,496 | 20,341 | 0.6 |

| Industrial | 14,358 | 10,525 | 36.4 |

| Building and construction | 8,520 | 14,485 | (41.2) |

| Services | 10,094 | 8,552 | 18.0 |

| Agriculture and fishing | 173 | 110 | 57.3 |

| Other | 1,068 | 2,802 | (61.9) |

| Sub total | 173,243 | 142,142 | 21.9 |

| Additional provision | (1,302) | (1,829) | - |

| Total net financing | 171,941 | 140,313 | 22.5 |

6 ibid

Among economic sectors, personal financing was by far the largest sector and contributor to the growth in net financing portfolio. It grew by nearly 40% YoY before additional provisioning, and accounted for a little over two-thirds (69%) of the net financing portfolio. It will be noted that personal financing in reality covers a very large customer base, who in turn represents a diversified group that serve to mitigate concentration risk.

Financing for the industrial sector grew by 36%, while the commercial sector remained almost static. Exposure to building and construction contracted by 41% reflecting a slow down in activities in this sector and its sensitivity to percentage change given its relatively small share of the total portfolio.

Investments

Investments, totalling SR 57,437 million, accounted for 21.5% of total assets as at 31 December 2012 (2011: 24.2%).

As will be seen in Note 7 to the consolidated financial statements, the largest component by far is Treasury's SR 38,276 million Murabaha with SAMA, which accounted for 93.6% of the total investment portfolio. The balance SR 2,604 million (6.4%) comprises investments held as Fair Value through Income Statement (FVIS), which includes Sukuk, equity investments and mutual funds.

Total investments grew by 5.3% during the year, driven by a 7.7% growth in Murabaha with SAMA, while investments held as FVIS declined by 20.6% YoY.

Income

Net financing and investment income grew by 4.8% from SR 9,070 million in 2011 to SR 9,501 million in 2012, and accounted for 67.9% of the SR 13,983 million total operating income.

Net fees from banking services and exchange income amounted to SR 3,086 million and SR 898 million respectively, with each contributing 22.1% and 6.4% to the total operating income.

Impairment charge (financing and other) increased by 41% to SR 2,319 million and accounted for 38% of total operating expenses.

The next largest expense item, salaries and employee-related benefits, increased by 7% to SR 2,100 million and accounted for 34% of total operating expenses, which in turn increased by 19% to SR 6,098 million.

As a net result, bottom line total comprehensive income increased by 6.9% from SR 7,378 million in 2011 to SR 7,885 million in 2012, with earnings per share reaching SR 5.26 through a corresponding increase.

Summary of Financial Performance by Business Segments

Year ended 2012, SR million

| Retail | Corporate | Treasury | Investment & Other |

Total | |

| Total assets | 128,452 | 54,592 | 81,304 | 3,035 | 267,383 |

| Total liabilities | 173,998 | 54,325 | 2,517 | 74 | 230,914 |

| Total income from operations | 9,557 | 1,926 | 1,250 | 1,250 | 13,983 |

| Total operating expenses | 4,423 | 1,355 | 49 | 271 | 6,098 |

| Net income | 5,134 | 571 | 1,202 | 978 | 7,885 |

Year ended 2011, SR million

| Retail | Corporate | Treasury | Investment | Total | |

| Total assets | 103,332 | 47,549 | 69,105 | 828 | 220,813 |

| Total liabilities | 135,608 | 45,571 | 4,928 | 1,885 | 187,992 |

| Total income from operations | 8,808 | 2,181 | 1,096 | 417 | 12,502 |

| Total operating expenses | (3,865) | (923) | (102) | (234) | (5,124) |

| Net income | 4,943 | 1,258 | 994 | 183 | 7,378 |

Retail Banking

The Group offers a wide range of asset and liability products as well as a host of fee-based services to individuals. The financial performance of these products and services were discussed in the preceding sections.

New Retail Products and Services

As part of our drive to continuously improve our response to consumer needs and preferences we research our markets, analyse trends and innovate new products and services to address gaps as well as to exploit opportunities in identified niches. A number of new retail products and services as well as enhancements were introduced during the year under review.

Branch Network and Remittance Centres

As at FYE 2012 the Bank had 462 branches (of which 102 had Ladies' Sections), eight Ladies Banking Units and four Private Banking Units in KSA. In addition the Bank had 162 Remittance or Tahweel Al Rajhi Centres by year end. Tahweel Al Rajhi continued to maintain its market leadership in the remittances business with the largest network of centres as well as having the largest network of correspondent banks.

ATM and POS Infrastructure

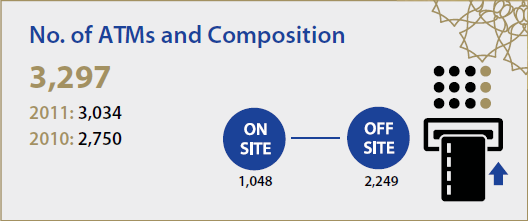

The ARB Group prides itself in having probably the best service infrastructure in KSA, including the largest ATM network. Our retail delivery channels include some 3,300 ATMs, 24,000 POS terminals plus a host of ancillary facilities such as Internet and mobile banking.

Technology continues to be a driver in product innovation to deliver greater customer convenience and satisfaction. For instance, customers may locate the nearest ATM on their smart phones and be guided through a map; they may even check the availability of the type of transaction they want to perform before visiting the ATM. We soon plan to introduce interactive teller machines that would work as if the customer stands in front of a real teller but virtually through video conference. The customer will be able to deposit onus Cheque, depositing money and withdrawing more than from a normal ATM.

Al Rajhi Merchant Acquiring Service continued to grow across more business segments during the year. With our vast POS network, we continue to offer merchants excellent service in terms of reach, support and post-sale services. During the year under review we introduced a new channel for merchants through the website for inquiries, complaints and requests. Further, the claim process was totally redesigned so that call agents now interact with merchants.

Online and Mobile Banking

We offer state-of-the-art online and mobile banking services. We were the first bank in KSA to offer share trading by mobile phone a few years ago. Continuing with such channel development commitment the Web 2.0 based online banking (Al Mubasher) was launched, which includes personal financial services. We will soon further upgrade our mobile services for smart phones to run on the Android OS. These are important strategic initiatives considering that a very large proportion of our society comprise youth who are technologically savvy. They are the early adopters who will seamlessly migrate from brick and mortar branches to electronic channels. Nevertheless, we continue to target our entire retail customer base through SMS and email shots on the benefits of non-branch virtual channels which are indeed mutually beneficial to both the customer and the Bank.

Corporate Banking

The Group delivers a wide range of business solutions to corporate customers and Financial Institutions (FI) through Shariah compliant products and services. Corporate customers range from large corporate, mid corporate and commercial organisations to Small and Medium Enterprises (SME).

The products include financing for working capital, trade finance, cash management and term financing as well as specialised products that are tailor made for a specific purpose.

Trade finance offers a full range of products and services including documentary credits, Musharaka contracts, documentary collections, shipping guarantees, export negotiations, export letter of credit advising/confirmation, guarantees, import finance and export finance. Cash management includes aspects such as cash collection, payroll, dividend distribution, direct debit, cash deposit and Muqeem.

Initiatives and Achievements

To promote customer loyalty we continued to conduct regular customer focused events and information sharing seminars across the region. These serve to educate customers on current trends and practices, especially on topics such as trade finance and cash management, and also create awareness of our various products and services that they may avail of.

To improve efficiency, we introduced an internal portal for Al Rajhi Bank trade finance management that measures the 'turnaround time to the customer'. Through this we track and benchmark our performance in carrying out the various activities to process customer transactions. Going further, a window for financing import bills received under letters of credit was added during the year. This complements the existing import finance option against import collections.

The existing customer front end, e-Corporate, was enhanced as part of a new release to include various facilities which were previously provided only by the normal banking channels. Other enhancements include the introduction of an SMS alert for cash management transactions and the substitution of existing hard tokens with soft tokens to improve the security of electronic transactions carried out by corporate customers from anywhere in the world. The latter also fulfils the multi authentication requirements of SAMA.

By highlighting the availability and convenience of our state-of-the-art e-banking channels we continued to move a significant volume of customer business to paperless transactions for mutual benefit.

Treasury

The Treasury provides services and products to the Bank's customers and manages the Bank's own liquidity and market risk requirements. It operates in both local and international foreign exchange and money markets to source funding and appropriate investments to enable the Bank to operate within its prudent guidelines as well as those of regulators.

Dealing in over 40 currencies and as a leading player in the foreign exchange market in the region, Al Rajhi not only adds depth and liquidity to the market but also provides visibility to the Al Rajhi Group in each of these offshore markets. This has helped the Bank to be the leader in FX revenues. In addition to traditional activities, Treasury also supports other departments of the Bank and their customers to facilitate Shariah compliant banking structures.

The financial markets in which the Bank operates are becoming more competitive with new entrants aggressively competing for market share. Demanding changes in the regulatory environment are increasingly impacting the way the Bank assesses and manages its risks. As with all other banks, globally, Al Rajhi Bank is continually reassessing its funding mix and liquidity management framework. The strong growth in lending assets, including potential longer term products such as mortgages, coupled with recovering markets offering customers broader investment choices, means that Treasury will need to continue to work on developing alternate funding sources.

Treasury expanded its physical presence in KSA by establishing a sales desk in the Eastern Region to provide a better access for local corporate customers. We are evaluating the prospects of opening another in the Western Region.

Considerable work was undertaken in 2012 to broaden the investment and liquidity management options of the Bank through Shariah compliant products. It is anticipated that many of these will be operational in 2013.

Investment Services and Brokerage

Investment banking advisory services, brokerage and asset management are provided through Al Rajhi Capital Company (ARC), a wholly-owned subsidiary of Al Rajhi Bank.

Brokerage

ARC's brokerage ranks No. 2 in market share in the Kingdom. It also offers trading in major GCC and international stock markets and Sukuk, which can be accessed through phone or Internet services. Other delivery channels include Automated Phone Trading, trading through mobile and telephone as well as specialised Central Trading Units that cater to clients with high trading volumes.

ARC occupies the top position in brokerage profitability through a prudent balancing of risk, reward and market share. Brokerage has cemented its leadership position and market share by investing in technology and new products. Commissioning of the new internet platform using Web 2.0 Technology during the year, which is the first in the Kingdom, helped ARC to move to No. 2 position within the Internet channel in terms of revenue. Other initiatives undertaken during the year included cross selling of asset management products through investment centres and strengthening the legal and compliance process with the full automation of the Power of Attorney System.

Asset Management

ARC is among the top five asset managers in KSA, and offers both packaged as well as tailor made investment products to meet the diverse investment needs of investors.

Significant initiatives during the year included launching of the Al Rajhi MENA Dividend Growth Fund, consolidation of existing Funds to provide a more relevant and focused product range to the customers, replacing the Sub – Manager and Custodian of the Al Rajhi Global Equity Fund with Credit Suisse AG, Zurich and appointing HSBC, Saudi Arabia for custody services of Sukuk securities invested through the Funds managed by the Company.

ARC Mutual Funds have been recognized and awarded consistently for their outstanding performance over the years by industry leaders, with the latest addition being the Saudi Arabia Asset Manager of the year 2012 from the Global Investor Magazine.

Investment Banking

ARC's investment banking arm offers strategic financial advisory services that include fund raising and debt/corporate restructuring services. Re-affirming its position as a leading provider of corporate finance advisory services as well as lead manager to publicly listed and privately held companies, ARC closed, among others, two notable transactions during the year, namely, the JODC Syndicated Loan of SAR 5 billion and the Zain Rights Issue of SAR 6 billion. In total, ARC was mandated on transactions with a collective value in excess of SAR 15 billion (USD 4 billion).

International Business Development

Going beyond product diversification, expansion of operations overseas represents Al Rajhi Bank's market diversification strategy. It helps the Bank to broaden the revenue base, thereby diversifying the sources of revenue rather than being dependent on the Kingdom only. It also reflects the Bank's vision to identify and capitalise on opportunities available in different geographic areas and jurisdictions. It gives the Bank entry into the emerging markets which have the potential to be larger markets. Our presence in these markets some of which are very demanding and challenging sophisticated markets help us to understand them. The Bank presently has operations in Malaysia, Kuwait and Jordan while plans are afoot for commencing operations in two other countries. Although the contribution of international business is relatively small as of date as shown in the table below, the Bank is confident that once they consolidate and stabilize their operations, they will start contributing to the bottom line in the medium term.

Contribution of International Business (SR)

| 2012 | 2011 | |

| Operating income | 274,759,293 | 265,705,897 |

| Total comprehensive income | (31,996,184) | (40,152,441) |

| Total assets | 10,771,374,130 | 8,303,364,560 |

| Financing (Retail & Corporate)* | 6,495,551,208 | 4,719,877,569 |

| Financing (inclusive of Treasury)** | 7,298,552,953 | 5,419,489,897 |

| Customer deposits | 3,433,613,669 | 2,839,869,615 |

* Include retail and corporate only without treasury

** Include all financing