Distinguished Shareholders

May peace be upon you,

The Board of Directors is pleased to share with you its annual report, which highlights the activities of the Bank for the fiscal year ended December 31, 2012.

Despite the continuing global financial crisis, the Bank succeeded in achieving a noticeable growth in all its activities and in recording good results in line with local economic conditions. Economic indicators reflect the Kingdom of Saudi Arabia's positive growth, which demonstrates the significant expansion, stability and diversification of the national economic base.

Moreover, the economic projections for the year 2013 point to continued growth in all the various economic sectors, including the banking sector.

Last year, the Bank completed its 25th year with a number of achievements to its name. It focused on developing banking services and providing financing products that meet the expectations of corporate and individual customers reinforcing the pioneering role played by the Bank in the Islamic banking services industry.

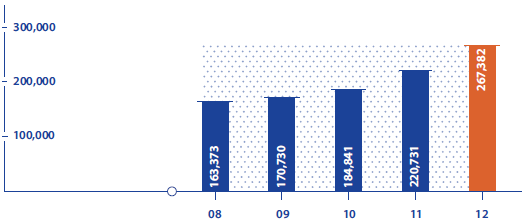

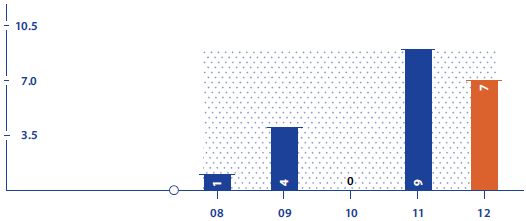

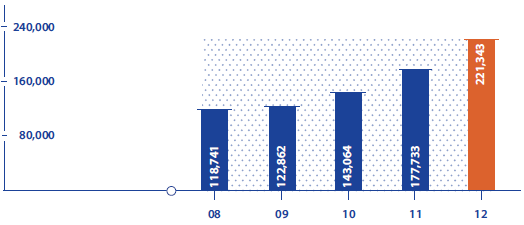

Total Assets

In SR millions

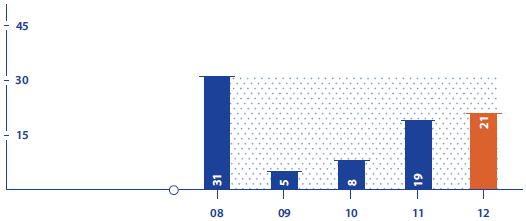

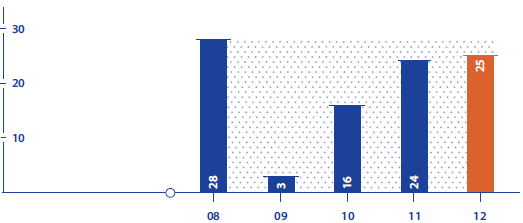

Asset Growth

%

1. Financial Results

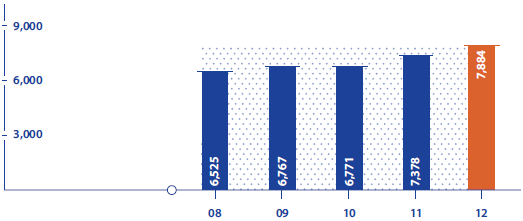

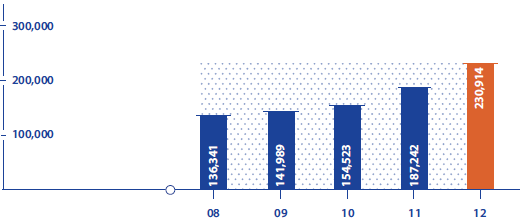

In 2012, the Bank recorded SR 7,885 million in net profit, compared to the SR 7,378 million of 2011, which is an increase of 7%. The financing net income and return on investment amounted to SR 9,501 million compared to SR 9,070 million in 2011, with an increase of 5%. The revenue on banking services reached SR 3,086 million in contrast to SR 2,298 million, which shows an increase of 34%. Total operating income amounted to SR 13,983 million compared to SR 12,502 million, an increase of 12%.

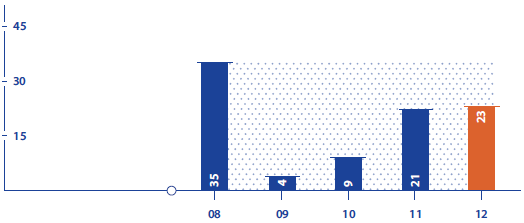

The financing portfolio is characterized by its diversification in corporate and individual products. Its net financing reached SR 172 billion compared to the SR 140 billion of 2011, with a growth rate of 23%. Meanwhile, shareholders' equity increased to SR 36 billion compared to SR 33 billion with a rise of 9%. Total assets reached SR 267 billion compared to the SR 221 billion of 2011 by way of a 21% increase. At the same time, customers' deposit balances went up to SR 221 billion compared to SR 178 billion showing an increase of 24%, which reflects customer trust in the Bank and also the noticeable growth of its market share in the banking sector.

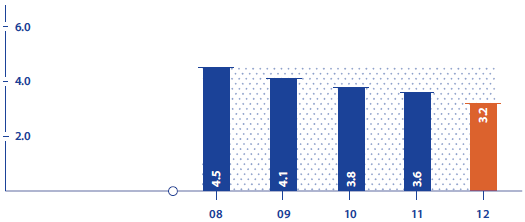

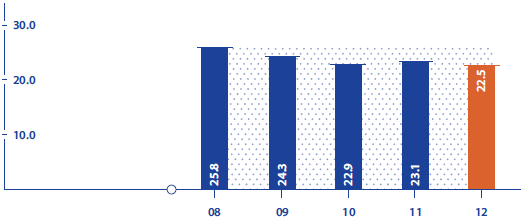

The Bank achieved a 3.23% return on assets, while return on shareholders' equity amounted to 22.54%, and profit per share reached SR 5.26.

Return on Assets

%

1.1 Impact of Bank's Major Activities

The following analyzes the Bank's total assets and liabilities, operating income, expenses and net income for the two years ended on December 31, 2012 and 2011.

2012 |

(SR '000) | ||||

| Retail | Corporate | Treasury | Investment | Total | |

| Total assets | 128,452,440 | 54,591,453 | 81,303,527 | 3,035,142 | 267,382,562 |

| Total liabilities | 173,997,759 | 54,324,761 | 2,517,174 | 74,131 | 230,913,825 |

| Total income from operations | 9,556,617 | 1,925,775 | 1,250,441 | 1,250,184 | 13,983,017 |

| Total operating expenses | (4,422,632) | (1,355,078) | (48,849) | (271,752) | (6,098,311) |

| Net income | 5,133,985 | 570,697 | 1,201,592 | 978,432 | 7,884,706 |

2011 |

(SR '000) | ||||

| Retail | Corporate | Treasury | Investment | Total | |

| Total assets | 104,231,281 | 47,556,774 | 64,668,892 | 4,274,138 | 220,731,085 |

| Total liabilities | 154,796,852 | 28,307,169 | 2,897,285 | 1,241,049 | 187,242,355 |

| Total income from operations | 8,847,921 | 1,831,557 | 1,107,327 | 715,314 | 12,502,119 |

| Total operating expenses | (3,689,385) | (1,083,848) | (42,476) | (308,142) | (5,123,851) |

| Net income | 5,158,536 | 747,709 | 1,064,851 | 407,172 | 7,378,268 |

Summary of net results of operations for the past five years (SR '000)

| (SR '000) | |||||

| 2012 | 2011 | 2010 | 2009 | 2008 | |

| Total assets | 267,382,562 | 220,731,085 | 184,840,910 | 170,729,729 | 163,373,224 |

| Financing and investment, net | 212,821,539 | 179,115,784 | 148,311,549 | 139,286,715 | 142,287,129 |

| Total liabilities | 230,913,825 | 187,242,355 | 154,523,121 | 141,988,845 | 136,341,425 |

| Total equity | 36,468,737 | 33,488,730 | 30,317,789 | 28,740,884 | 27,031,799 |

| Deposits | 221,342,916 | 177,732,952 | 143,064,037 | 122,861,840 | 118,741,042 |

| Net profit | 7,884,706 | 7,378,268 | 6,770,829 | 6,767,228 | 6,524,604 |

| Share profit | 5.26 | 4.92 | 4.51 | 4.51 | 4.35 |

1.2 Geographical Analysis of Revenues

The Bank's net income is derived from both its local and international activities.

| Inside KSA | Outside KSA |

| (SR '000) | (Asia) |

| 7,899,737 | (15,031) |

There are no debts owed by the Bank upon request or otherwise.

Net Income

In SR millions

Net Income Growth

%

2. Subsidiary Companies

The Bank owns several subsidiary companies that contribute to managing its activities and diversifying its revenues. The following table describes the percentage and the nature of the companies' ownership as per the year ended on December 31, 2012:

| Ownership % | Type of activity | Country (place of operation) |

Country (place of establishment) |

||

| 2012 | 2011 | ||||

| Al Rajhi Financial Services Company | 100% | 99% | Financial services | KSA | KSA |

| Al Rajhi Banking & Investment Corporation (Malaysia) BHD |

100% | 100% | Banking services | Malaysia | Malaysia |

| Al Rajhi Banking Investment Company (Kuwait) |

100% | 100% | Financial services | Kuwait | KSA |

| Al Rajhi Banking Investment Company (Jordan) |

100% | 100% | Banking services | Jordan | KSA |

| Al Rajhi Takaful Agency | 99% | 99% | Insurance services | KSA | KSA |

| Al Rajhi Development Company Ltd. (Riyadh) |

100% | 100% | Real estate | KSA | KSA |

The Bank confirms that there are no shares and debt items issued for each subsidiary company.

3. Dividend Distribution

After the deduction of all overhead expenses and other costs, the Bank distributes the specified annual net profits, arranges the necessary reserves to confront doubted debts, investment losses and urgent commitments for which the Board of Directors evaluates the risk level under the Bank's monitoring laws and regulations, and SAMA rules and instructions:

- The due zakat amounts scheduled to be paid by shareholders are calculated and the company distributes them to designated parties.

- The Bank transfers no less than 25% of what is left from the net profits to the following year after deducting the zakat of the regular reserves so that the mentioned reserves become equal - at least - to the paid capital.

- It allocates no less than 5% of the paid capital to next year's transferred amount of profits after deducting the regular reserves and zakat. This is to be distributed to shareholders according to what the Board of Directors suggests and what the General Assembly approves. If the percentage left from the profits due to shareholders is insufficient to pay the above-mentioned percentage, the shareholders cannot claim to pay it during the next year(s) and the General Assembly cannot decide to distribute a bigger percentage of profit than the one suggested by the Board of Directors.

- After allocating the amounts mentioned in items (a), (b) and (c) the rest will be used according to the suggestion of the Board of Directors and the decision of the General Assembly.

The profit shares are paid to shareholders in the time and place defined by the Board of Directors. The company has the right to withhold the due profit shares of any shareholder and to use them as payment in case the shareholder has debts and commitments yet to be made to the Bank.

After the deduction of all overhead expenses and other costs, the Bank distributes its net profits under article (41) provision of the Bank's main regulations and related laws. As a result of its outstanding performance and achievement in terms of net profits, this year - thanks to Allah - the Board recommends distributing its net profits as follows:

| Description | (SR '000) |

| 2012 profit | 7,884,706 |

| Profit from 2011 | 32,279 |

| Interim dividend distribution during the first half of the year, at the rate of SR 1.25 per share |

1,875,000 |

| Proposed dividend distribution during the second half of the year, at the rate of SR 2 per share |

3,000,000 |

| Transfer to legal reserve | 1,043,549 |

| General reserve | 0 |

| Zakat accruals | 850,000 |

| Profit to be transferred to next year | 1,148,436 |

4. Board of Directors

The Board of Directors consists of 11 members elected by the Constituent General Assembly every 3 years. Each member can be re-elected after completing his term in accordance with the Bank's regulations. According to the definitions of article 2 of the Corporate Governance Act of Saudi Arabia, issued by the Capital Market Authority, members are classified as follows:

4-1 Classification of the Board of Directors

| Name | Function(s) | Membership type | Membership in other joint stock companies |

| Sulaiman bin Abdulaziz Al Rajhi | Chairman of the Board of Directors |

Non-Executive member | Yanbu Cement Companies, NADEC Agricultural Company |

| Abdullah bin Sulaiman Al Rajhi | Board of Directors Member | Executive member | Al Rajhi Takaful Agency |

| Sulaiman bin Saleh Al Rajhi | Board of Directors Member | Non-Executive member | |

| Abdullah bin Abdulaziz Al Rajhi | Board of Directors Member | Non-Executive member | |

| Salah bin Ali Abal Khail | Board of Directors Member | Non-Executive member | |

| Bader bin Mohammed Al Rajhi | Board of Directors Member (representative of Manafea Holding Co.) |

Independent member | |

| Mohammed bin Abdullah Al Rajhi | Board of Directors Member | Non-Executive member | Tabuk Agricultural Company |

| Ali bin Ahmed Al Shidi | Board of Directors Member | Independent member | |

| Saeed bin Omar Al Issaee | Board of Directors Member | Independent member | Yanbu Cement Company, Sahara Company, Sanadh Company |

| Mohammed bin Othman Al Bishr | Board of Directors Member | Independent member | |

| Abdulaziz bin Khaled Al Ghefaily | Board of Directors Member (representative of General Organization for Social Insurance) |

Non-Executive member | Savola Company, Harfi Company |

- There are no arrangements or agreements made under which any of the members of the Board of Directors or Senior Executives waived his salary or compensation to the Bank.

- There are no arrangements or agreements made under which any of the Bank's shareholders waived any of his profit rights.

- According to the Bank Regulation Act No. 28 the Corporate Governance have facilities through the financial regulations of the Bank.

4-2 Number of Sessions & Attendees

The Board of Directors held the following seven sessions during 2012:

| No. | Date | No. of attendees |

% attended | Absent members |

| 1. | 17/01/2012 | 10 | 91% | Abdulaziz bin Khaled Al Ghefaily |

| 2. | 04/03/2012 | 11 | 100% | - |

| 3. | 13/05/2012 | 11 | 100% | - |

| 4. | 15/07/2012 | 11 | 100% | - |

| 5. | 24/09/2012 | 10 | 91% | Bader Mohammed Abdulaziz Al Rajhi |

| 6. | 18/11/2012 | 11 | 100% | - |

| 7. | 26/12/2012 | 10 | 91% | Saeed bin Omar Al Issaee |

Number of each member's attended sessions during 2012:

| Name | Attended sessions |

| Sulaiman bin Abdulaziz Al Rajhi | 7 Sessions |

| Abdullah bin Sulaiman Al Rajhi | 7 Sessions |

| Sulaiman bin Saleh Al Rajhi | 7 Sessions |

| Abdullah bin Abdulaziz Al Rajhi | 7 Sessions |

| Salah bin Ali Abal Khail | 7 Sessions |

| Bader Mohammed Abdulaziz Al Rajhi | 6 Sessions |

| Mohammed bin Abdullah Al Rajhi | 7 Sessions |

| Ali bin Ahmed Al Shidi | 7 Sessions |

| Saeed bin Omar Al Issaee | 6 Sessions |

| Mohammed bin Othman Al Bishr | 7 Sessions |

| Abdulaziz bin Khaled Al Ghefaily | 6 Sessions |

4-3 Committees of the Board of Directors

The Board of Directors executes its functions and missions through major committees formed by Board Members. The Audit Committee consists of 5 non-executive Board Members.

4-3-1 Executive Committee:

The Executive Committee, headed by the CEO, carries out all the functions and authorities the Bank entrusts it with, including: credit facility approvals; cancellation of debts and all losses that go beyond the competence of the Bank's High Credit Committee; the selling of real estate; and the approval of contracts that go beyond the authority of the Bank's working committees and CEO. It also studies all matters that require a Board recommendation or decision. The Committee held 7 sessions in 2012 and its members are, Sulaiman bin Abdulaziz Al Rajhi (President), Abdullah bin Sulaiman Al Rajhi, Salah bin Ali Abal Khail, Sulaiman bin Saleh Al Rajhi, and Abdulaziz bin Khaled Al Ghefaily.

4-3-2 Remuneration& Rewards Committee:

This Committee is formed by 3 members: Salah bin Ali Abal Khail (President), Sulaiman bin Saleh Al Rajhi and Abdulaziz Al Ghefaily. It is in charge of functions assigned to it through executive by-laws. The Remuneration & Rewards Committee's main purposes include: to recommend the selection of Board Members or Committee members; to fill vacant positions according to the adopted policies and criteria; to conduct the annual review that defines the required needs of suitable membership skills; to review the Board's structure in order to define its strong and weak aspects, and submit recommendations accordingly; to set clear policies that determine salaries and remunerations for members and senior executives; and present an annual recommendation to the Board regarding the annual budget for the special remunerations and incentives of senior executives. This Committee held 2 sessions in 2012, and also published 12 Nos of statements.

4-3-3 Audit Committee:

The Audit Committee plays a fundamental role in helping the Board of Directors meet its obligations by performing all supervision and governance matters related to financial audit, managing the internal review according to the Bank's possible risks, and review the competence, independence and performance of internal and external auditors. It also works on improving and developing supervision norms, and subsequently the protection of shareholders' equity through the following: the study of consolidated financial statements, accountability policies, internal supervision system, and making recommendations in this regard; also the supervision of the management of internal review, studying reports and verifying efficiency and independency, recommending to designate external auditors, studying their plans, defining their salaries, and deciding on their dismissal and the execution of tasks or other missions assigned to it. The Audit Committee held 5 sessions in 2012, and its members consisted of: Sulaiman bin Saleh Al Rajhi (President), Sultan bin Mohammed Al Sultan, Ali bin Ahmed Al Shidi, Abdullah bin Ibrahim Al Sayyari, and Mohammed bin Ghazi Al - Thamam.

4-4 Ownership of Board Members & Senior Executives

Changes in ownership percentages for Board Members and their families are defined as shares, Bank's debt items, or any of its subsidiary companies.

Table 4-4-1: Description for any interest of the Board Members and their families (wives & children) are defined as shares, Bank's debt items, or any of its subsidiary companies.

| No. | Name | No. of shares at beginning of year |

No. of shares at end of year |

Net change | % of change |

| 1 | Sulaiman bin Abdulaziz bin Saleh Al Rajhi | 301,780,074 | 301,997,157 | 217,083 | 0.07% |

| 2 | Abdullah bin Sulaiman bin Abdulaziz Al Rajhi | 30,165,283 | 30,165,283 | - | 0.00% |

| 3 | Abdullah bin Abdulaziz bin Saleh Al Rajhi | 90,230,427 | 90,839,996 | 609,569 | 0.68% |

| 4 | Mohammed bin Abdullah bin Abdulaziz Al Rajhi | 5,888 | 1,021,788 | 1,015,900 | 17,253.74% |

| 5 | Sulaiman bin Saleh bin Abdulaziz Al Rajhi | 34,141 | 3,694,857 | 3,660,716 | 10,722.35% |

| 6 | Saeed bin Omar bin Casim Al Issaee | 2,608,155 | 2,394,155 | -214,000 | -8.21% |

| 7 | Ali bin Ahmed bin Ali Al Shidi | 298,111 | 400,000 | 101,889 | 34.18% |

| 8 | Salah bin Ali bin Abdullah Abal Khail | 1,260,000 | 1,260,000 | - | 0.00% |

| 9 | Mohammed bin Othman bin Ahmed Al Bishr | 399,777 | 399,777 | - | 0.00% |

| 10 | General Organization for Social Insurance | 148,694,166 | 148,694,166 | - | 0.00% |

| 11 | Abdulaziz bin Khaled bin Ali Al Ghefaily (insurance representative) |

- | - | - | 0.00% |

| 12 | Manafea Holding Co. | 32,752,680 | 30,751,184 | -2,001,496 | -6.11% |

| 13 | Bader bin Mohammed bin Abdul Aziz Al Rajhi (representative of Manafea Holding Co.) |

- | 152,565 | 152,565 | 0.00% |

Table 4-4-2: Description for any interest of Senior Executives and their families (wives & children) are defined as shares, Bank's debt items, or any of its subsidiary companies.

| No. | Supervising party | No. of shares at beginning of year |

No. of shares at end of year |

Net change |

% of change |

| 1 | Suliman Abdulaziz Azzabin | 795 | 2,721 | 1,926 | 242.26 |

| 2 | Saeed Mohammed Al-Ghamdi | 7,197 | Resignation date: 04/03/2012 |

- | 0.00 |

| 3 | Ahmed Bin Saleh Al-Khaleefy | 1,250 | 3,469 | 2,219 | 177.52 |

| 4 | Waleed Abdullah Al-Moqbel | 15,000 | 30,000 | 15,000 | 100.00 |

| 5 | Abdullah Abdul Rahman Al-Namlah | 1,023 | 3,176 | 2,153 | 210.46 |

| 6 | Damian Philip White | - | - | - | 0.00 |

| 7 | Adnan Abdullah Al-Olayan | 2,576 | - | -2,576 | -100.00 |

| 8 | Khaldoon Abdullah Al-Fakhiri | 1,125 | Ending Membership date: 01/09/2012 |

- | 0.00 |

| 9 | Tariq Abdullah Hassan Al-Naeem | Membership date: 20/11/2012 | - | - | 0.00 |

| 10 | Ali Ahmed Abdullah Al-Karni | Membership date: 17/04/2012 | - | - | 0.00 |

| 11 | Anand Murthi Sharma | Membership date: 02/09/2012 | - | - | 0.00 |

Total Liabilities

in SR millions

Liabilities Growth

%

5. Remunerations & Compensations

The Bank pays the expenses and remunerations of Board Members who attend the Board sessions, as well as that of the subsidiary committees under article 19 provision of the Bank Article of Association. It also pays salaries, remunerations and compensations to Senior Executives in accordance with their respective contracts and SAMA list of remunerations and compensations. The following is a detailed description of all expenses, remunerations and salaries paid to Board Members and the 7 Senior Executives of the Bank, including the CEO and the CFO.

| Supervising party | Executive Board Members |

Non-Executive Board Members |

Senior Executives (including CEO & CFO) |

| Salaries & remunerations | 0 | 0 | 9,346,120 |

| Allowances | 0 | 114,000 | 2,134,740 |

| Periodic bonuses | 0 | 2,760,000 | 4,102,433 |

| Incentive plans | 0 | 0 | 1,256,336 |

| Other remunerations or benefits paid on a monthly/annual basis |

0 | 0 | 0 |

| Total | 0 | 2,874,000 | 16,839,629 |

6. Penalties & Fines Imposed on the Bank

The Bank was not subjected to any significant penalty procedures or fines in the financial year 2012. Most, penalties imposed, if any, were related to operational processes and were successfully dealt with.

The following is the penalty statement imposed by the supervising authorities:

| Supervising party | No. of fines | Total fines |

| Saudi Arabian Monetary Agency (SAMA) | 18 | 839,667 |

| Ministry of Municipal & Rural Affairs | 2 | 2,601,650 |

7. Regulatory Payments

The Bank's regulatory payments during the year 2012 consist of zakat due by shareholders, amounts paid to the general organization for social insurance represented by the employees' insurance, and taxes represented by deductible debts imposed on foreign investors.

The following table explains the regulatory payments:

| Party | (SR '000) |

| Zakat due from shareholders | 850,000 |

| General Organization for Social Insurance | 165,461 |

| Taxes/fees or any other due payments | 4,089 |

| Total | 1,019,550 |

8. Employee Benefits & Plans

The employees' benefits and plans are paid during or at the end of their service and according to Saudi Labor Laws and Bank policies. The balance for the allocations of end of service reached SR 549 million at the end of 2012. The Bank also provides its employees with a number of benefits such as:

The program of granting Bank shares to benefit selected employees is one that is dedicated to the Bank's employees and its subsidiary local companies. It offers free shares to senior employees who the Fund's Board decides are to be retained due to their value as human assets. This action enhances long-term functional relationships and provides suitable incentives to recognize distinguished contributions.

Return on Shareholders' Equity

%

9. Accounting Records

The Board of Directors assures the following:

- Accounting records have been correctly prepared.

- The internal supervision and control system has been properly prepared and efficiently executed.

- There are no doubts regarding the Bank's capability to carry on with its activities.

10. Annual Audit Results of the Internal Control System's Effectiveness

The Bank's Internal Control System has been properly prepared and efficiently executed. It is subject to constant evaluations and improvement to allow for the identification of any gaps and meet the required level of effectiveness, key controls include:

- Existence of a series of policies and procedures, which are subject to regular updates and reviews to verify their sufficiency and adequacy.

- Most of the Bank's operations are executed automatically through a sophisticated electronic system, which minimizes errors and fraud opportunities.

- All work and major important decisions are supervised through committees created for this purpose and to protect the safety and quality of the Bank's assets.

- Existence of departments specialized in fields of audit, compliance control and risk management.

- Existence of the Audit Committee in order to contribute to reinforcing the independence of internal and external auditors. This Committee receives regular reports about the activities of the departments subject to auditing.

- Regular supervision of the efficiency and sufficiency of the Internal Control System based on an annual plan approved by the Audit Committee. Aspects of Internal Control are regularly supervised by the auditors and tested by SAMA.

- Great attention is paid to the Internal Control System's results and every identified issue is taken into consideration in order to avoid repetition of mistakes.

11. Future Risks View for the Financial Year 2013

Despite the continuing global financial crisis and the subsequent international challenges it imposes on most industrial countries, top of which is the United States and Euro-zone countries, the Saudi economy is expected to continue witnessing positive growth. This is thanks to the financial policies that aim to increase government spending and the efforts deployed to contain inflation.

Under the economic circumstances expected for 2013, particularly those that relate to increased government spending in vital sectors such as housing and infrastructure and contribute positively to the individual income average, the Bank has promising growth chances due to its ability to capitalize on its strong local presence.

Thus, the Bank will continue to focus on increasing its customer base by promoting both the Retail and Corporate Banking sectors, developing its international presence and offering products suitable to the needs of customers. The Bank is also working on enhancing its services by expanding communication channels with customers through branch networks, ATMs, call centers, e-services, etc.

Risks are part and parcel of the banking industry and hence the Bank's activities are exposed to several financial risks that require analysis, assessment and management of one or more types of these risks.

In this context, the Bank aims to balance its potential risks and returns, and minimize any possible negative results that might affect its financial performance. It sets policies, procedures and regulations related to risk management in the Bank in order to define and analyze these risks, then put the right control and supervision practice in place to minimize and review them.

The Bank does this consistently to meet the challenges presented by market and product changes, and adopt the best banking practices. The Credit & Risk Management Department will continuously strive to manage the risks according to the policies adopted by the Board and define and assess the financial risks in collaboration with all the Bank's departments. This practice has been key to the Bank's ability to manage capital efficiently and provide strong shareholder returns.

12. The Corporate Governance Act

The Bank works under the terms, by-laws and guidelines of the Corporate Governance Act, which is issued by the Capital Market Authority. The Bank's Board has applied the Act's obligatory by-laws. In 2011, the Bank prepared its own Governance Act with respect to the requirements of the Governance Act issued by the Capital Market Authority. It is also preparing an independent policy related to conflict of interests and expects to adopt it before the end of the second quarter of the year 2012, under CMA decision no. 1-33-2011.

The Bank's management has applied most of the guidelines and by-laws in addition to SAMA requirements related to remunerations and compensations, as well as what is mentioned in the Saudi Corporate System. Through its policies and internal procedures, the Bank guarantees its commitment to disclose the vital information to stakeholders such as customers, shareholders, suppliers, employees and borrowers. In parallel, it has a policy of banking information and data disclosure in accordance with SAMA regulations, and it commits to abide by CMA disclosure requirements. It is worth mentioning that the Bank has a policy for Social Responsibility that is one of the main pillars of its current activities. It is an independent department, the "Social Service Department", is following up on the application of this policy within the Bank. The Department reports to the CEO and focuses on enhancing the Bank's social role.

The Bank did not apply some of the by-laws and guidelines mentioned in the Act during 2012; however, it is preparing to do so. They are as follows:

- Prepare a written policy that includes clear criteria for Board Membership and implement it. Also set written procedures in order to share the Bank's financial and legal aspects and activities with new members, as well as training them, if needed, on new legislative, regulatory, economic and other developments that contribute to their performance as members.

- Adopt a unified policy related to authorizing privileges to the Board, which enables the definition of the Executive Department privileges, the decision making procedures, and authorization period, all the while considering that the Bank currently has several policies associated with the privileges given by the Board to the Executive Department Team. They are related to the application of HR, and risks and complaints strategies in a way that protects both the interests of the customers and that of the Bank.

Customer Deposits

In SR millions

Customer Deposits Growth

%

- Develop the policy of defining mechanisms of compensation to those who have interests with the Bank in case their rights, approved by laws and regulations and protected by contracts, were violated. The policy also aims to clarify mechanisms of resolving complaints or disputes that might happen between the Bank and those with the interests.

- Regarding the Accumulative Voting requirements, the Bank's main system decides on the right of normal vote according to the Saudi Corporate System. This is why it has yet to apply these requirements; it needs the exceptional General Assembly's approval because it is considered to be a change to the main system itself.

- In addition, the main system does not mention the right for shareholders to get a portion of the Bank's corporate assets in case of liquidation, since everything related to their rights is governed by the special regulations related to corporations and their liquidity.

- Subject to the Policy on Conflicting Interests adopted by the Bank in the month of June 2012, Directors' interests in contracts with the Bank will be disclosed at the meeting of the General Assembly in the first quarter of 2014. All these contracts are for leases on buildings being used for housing branches or ATM machines of the Bank.

- The Bank promises that consideration will be given to the obligation of all persons with legal capacity, and they will have the right to designate others to represent them and act on their behalf in the Board, and refuse voting for the selection of other members. These requirements were included in the Governance Act as a commitment to their fulfillment.

- Finally, all the General Assembly items of the year 2011 contained enough information to enable shareholders to make their decisions, except for the item regarding agreement on the election of the new round of Board Members. This item did not include the candidates' profiles because most of the members were re-elected after getting SAMA approval, apart from only one new member. The Bank commits to providing the profile of any new candidate and presenting it to the General Assembly in the future.

13. Auditors

During the Constituent General Assembly of shareholders, dated 04/03/2012, Ernst & Young and PriceWaterhouseCoopers have been re-designated as auditors of the Bank's accounts for the fiscal year 2012. The next Constituent General Assembly will -Allah willing- re-designate the current auditors or choose other ones for the fiscal year of 2013, based on a recommendation from the Audit Committee.

14. Conclusion

The Board of Directors is pleased to express their pride in the positive results achieved by the Bank in 2012. On this occasion, the Board wants to convey its appreciation to the Custodian of the Two Holy Mosques, King Abdullah bin Abdulaziz Al Saud, as well as the Crown Prince, Deputy Prime Minister and Minister of Defence, HRH Prince Salman Bin Abdul Aziz, and our prudent Government.

The Board would also like to express its sincere appreciation to the Ministry of Finance, Ministry of Commerce & Industry, Saudi Arabian Monetary Agency (SAMA) and the Capital Market Authority (CMA) for their consistent cooperation and support in developing the banking sector, which manifests itself in the reinforcement of the national economy.

The Board Members present their gratitude to their eminence the Chairman, and the members of the Bank's Shariah Board for their efforts and contributions in the forms of advice, patience and explanations on all issues presented to them with regards to the banking and investment activities and services offered to the Bank's customers. The Board prays that Almighty Allah would most excellently reward them for their efforts.

The Board would also like to seize this opportunity to express its gratitude and appreciation to the honorable shareholders, correspondents and customers for their support, trust and cooperation, which has led to the achievement of further advancement and prosperity for the Bank and the Board would like to present its sincere appreciation to all the loyal Bank employees for their genuine efforts and devotion in accomplishing their obligations and tasks.